Grandfathered Zoning Rules in Philadelphia: An Update

Permits and Licenses Made Easy

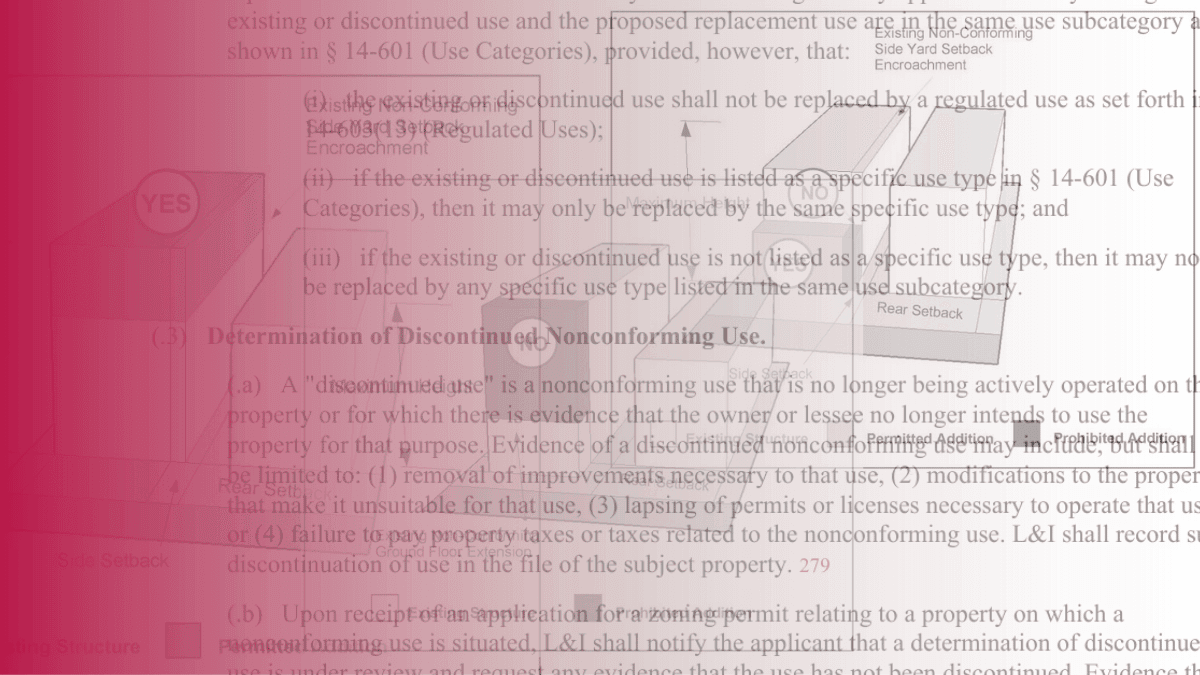

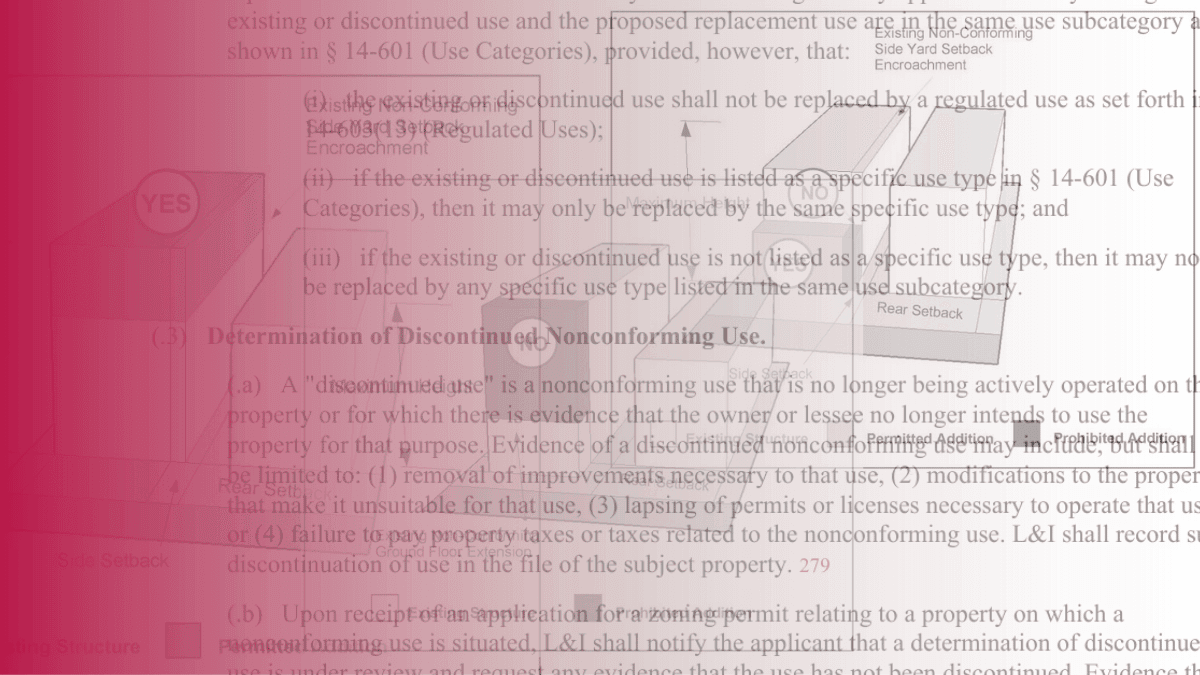

At the beginning of 2025, we told passionate, dedicated readers of the Permit Philly blog (we assume there are millions of you) that the City of Philadelphia was going to crack down on grandfathered zoning. Saying a property is “grandfathered…

Philly’s hottest new municipal office is… well, an office that’s been around for ages: Air Management Services! For whatever reason, we’ve heard a lot of chatter lately about AMS from contractors and developers. They pass harrowing tales of between themselves,…

Happy New-ish Year! As Philadelphia slowly emerges from the eggnog fog into the harsh winter light, it’s time to discuss what’s on everyone’s mind: the Eagle’s depressing passing attack, which could doom the league’s most talented roster and best defense.…

It happens all the time: someone comes to us because the City of Philadelphia told them to get new permits just to keep their property the way it was. Say, for example, someone purchased a triplex, but when they applied…

Philadelphia has property taxes: each parcel and building in town is worth something, and the City of Philadelphia wants a cut of that worth – a cut of property value. When the price of your house goes up, the City…

We’ve heard a lot from our clients about permit expirations recently: Contractors, property owners, and even homeowners working on small renovation projects have found their construction and zoning permits out of date: marked “expired” and closed in the City of…

We get a lot of questions and comments about these articles. Take a look for yourself!